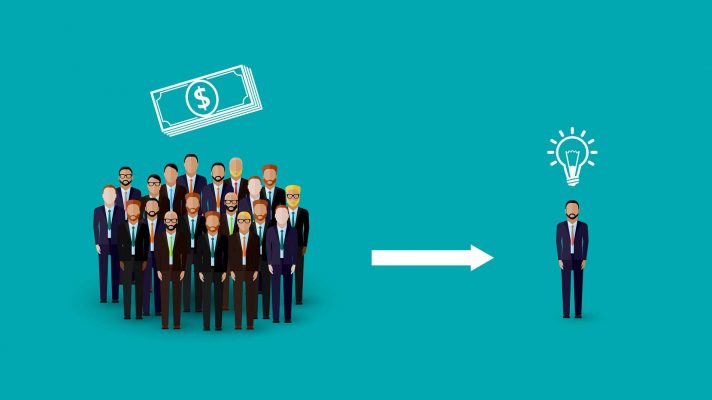

Real estate crowdfunding is a new trend that’s opened unlimited possibilities for investors across the world. New inventions through Kickstarter, t-shirt fundraisers through Teespring, private donations through GoFundMe, and a ton of charitable giving for a plethora of causes. However, the real estate market is one industry that has been relatively impenetrable for an entry-level investor. That is… until now. The Jumpstart Our Business Startups (JOBS) ACT removed many of the barriers that existed preventing your entry-level investor from “jumping” in. It’s changed the game by allowing for properties to be marketed publicly, increased the amount of information that is given to investors, and lowered minimums of entry.

Real estate investment opportunities used to be limited to private connections and personal networking. The JOBS ACT helped eliminate the restriction on general solicitation to allow for public offerings of opportunities. So much so that there are now major websites that are dedicated to the sale and advertising of real estate investments. In a Bloomberg article there was last reported over 125 crowdfunding sites in the US and over $484 million invested in 2015. Real estate investing is no longer for the super rich but is now open to anyone to invest. Some of the investment opportunities are from house flippers/renovators looking to borrow money for the flips. Some offer equity stakes during the project’s existence. And some fund loans for large commercial endeavors. All of this can be done in the comfort of one’s own home looking at a computer screen.

Not only has real estate investment been given public marketing avenues it’s also allowed for lower minimums. The barrier of entry into investment has been drastically lowered. It’s now possible to start investing in real estate with as little as $1,000. Many of the main sites have a $5,000 minimum which is still substantially lower than if you were attempting to invest on your own. Additionally, you may be entitled to all of the same tax benefits, such as depreciation, that typically apply to owning property. Be sure to check with your tax professional to confirm exact benefits. Non-accredited investors can now easily try their hand at investing.

Another huge benefit that’s come out of crowdfunding real estate is a large degree of transparency. Of the over 125 crowdfunding sites available, a large portion carefully vet each deal beforehand. They make sure to receive as much information as possible on every transaction and put it in the hands of the investors. It used to be that you’d enter into a deal with little information and infrequent updates at best. Crowdfunding has brought about increased honesty and a broad range of information for investors to make the best decisions possible.

Real estate investing doesn’t come without risks, though. For starters, risk valuations related to the investment are often evaluated by either the crowdfunding sites or the construction developer. Whereas you have other investment opportunities which may have a third party analyzer and less bias. Another large risk is that there are no guarantees that a property will sell OR if it’ll sell at the expected price. It’s largely subjective and can ebb and flow with the market conditions.

Real estate crowdfunding may just be the next biggest game changer in the industry. Many of the largest barriers preventing an average investor have been removed, minimums to entry have been lowered, and it’s a more transparent way of buying real estate investments. Looking for other ways to become an investor, check out this guide to becoming a real estate investor.